Revealed: Kent's most expensive roads to live on

Sevenoaks dominates the most affluent roads in Kent. Plus: Maidstone United FC find glory on-and-off the pitch

Property prices are in the news as the UK’s top banks release their latest house price data and predictions for 2024. Kent’s property market has been through its own journey in recent years but the market has remained relatively robust despite a tougher lending market - buyers are moving slower but house prices have been resilient. In this edition, we delve into Kent’s prime property market, e.g. houses valued at over £1mn in today’s market, and explore which areas are winning. If this newsletter was forwarded to you, please consider subscribing so you don’t miss a future edition:

- Editor, The Kent Business Post

How is Kent’s prime property market performing

Exclusive analysis shows how the top of Kent’s property market is evolving as high mortgage rates hit transaction volumes but property prices remain resilient for now.

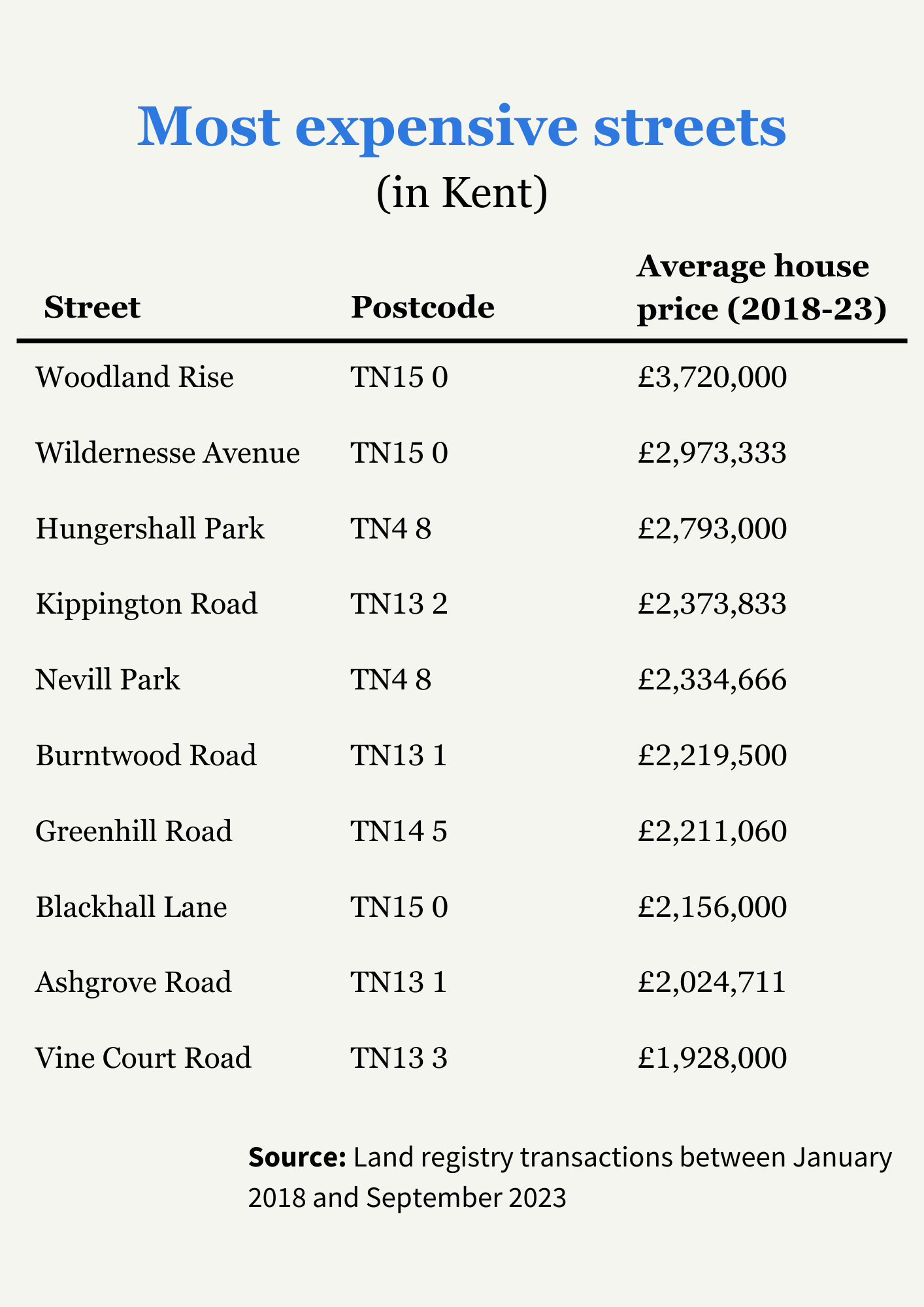

New research from The Kent Business Post has revealed that Woodland Rise in Sevenoaks is the most expensive road to buy a property in Kent - property prices on the road are nearly 13 times the value of the average UK property price.

Average property sales on the street, located on the private Wildernesse Estate, are an eye-watering £3.72 million. The Wildernesse Estate is a standout residential haven, boasting exceptional homes against a backdrop of rural tranquility. The estate traces its roots back to the 1920s with its history revolving around the historic Wildernesse House. Houses are strategically developed on expansive individual plots across an impressive 300-acre canvas. Currently no properties are listed for sale on Woodland Rise with only five properties changing hands since 2018 on the street, further highlighting the road’s exclusivity.

Running adjacent to Woodland Rise, in second spot is Wildernesse Avenue which has an average price tag of nearly £3 million, at £2.973mn. Completing the top three is Hungershall Park in Tunbridge Wells which is located next to the Nevill Park and a short walk away from the iconic Pantiles. The average property sale on Hungershall Park is £2.793mn.

It comes as no surprise that eight out of the top ten roads are located in Sevenoaks with the average property sale coming in at about £625,000 across the district in the first half of last year - 49% more than the county’s average property price. The other two roads are located in Royal Tunbridge Wells which has long boasted elevated property prices due to its local amenities, strong middle classes, good schools, and great transport links to London and the South East of England.

Across the board, these roads are highly sought after and exclusive with few houses changing hands between 2018 to 2023. This is in spite of the post-pandemic stamp duty pause which would have financially benefitted homeowners significantly on these roads and led to above average transactions across the UK. Analysing the top 10 hot spots, on average only 1-2 properties on each road change hands every year.

Higher rates weigh on indebted prime market

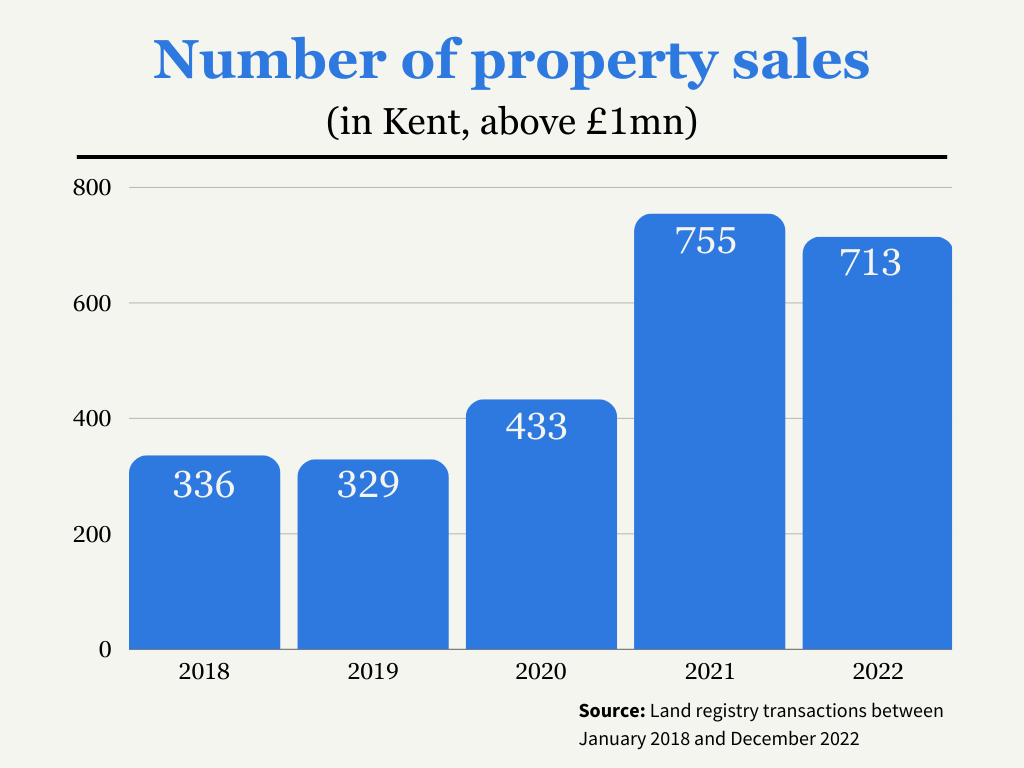

During 2018-2022, 2,568 houses were sold for over £1 million in Kent which was a whopping 191% increase from the five-year period before (2013-2017). There was a significant jump in the number of transactions over £1mn in 2021 after the lockdowns as low borrowing costs, elevated demand, and the removal of the stamp duty tax pushed more properties across the Kent into the £1mn plus bracket.

However, in the first half of 2023, the number of property sales above the £1mn mark dropped by 29.6% year-on-year as consecutive interest rate rises from the Bank of England and the Liz Truss budget the previous year created a surge in mortgage rates. Savills reports that ‘as interest rates have risen, buyers have had to adjust their budgets accordingly, particularly in markets most reliant on debt.’

However, of the properties that did exchange for over £1mn in Kent during the first half of last year, the average selling price dropped by only 1.87% to an average of £1.448mn. Yet, this is ten times less than in London, where a property on one of the capital’s most expensive streets would put a buyer back a whopping £14.5 million on average.

Reflecting on this decline in properties sold at the top of the market, Knight Frank noted in their recent prime global property forecast: ‘on the supply side, we're seeing a reluctance among mortgaged households to move, plus, high construction costs, persistent labour shortages, and planning delays are collectively contribute to a shortage of new stock entering the market.’ Perhaps the reluctance to sell is further reflected in recent price drops with Savills predicting that by the end of 2024, values are forecast to be down in the regions by a total of -8.1% since the mini-budget in September 2022.

Despite this, it is believed that better days are ahead. Savills forecasts that, on average, prime property growth is expected to total 18.6% in the five years to 2028 in the commuter belt, and 19.1% in the wider south. More to come on this in the months ahead.

BUSINESS NEWS IN BRIEF

🚛 Express European Couriers in Tonbridge have partnered with Pallet-Track as they look to cover several TN postcodes for the Wolverhampton firm. With 15 staff and a fleet of 16 vehicles, the haulier provides palletised freight distribution throughout the county, with links to Europe and overseas.

📦 Ashford is set to get three new warehouse units after proposals have been made to demolish the Invicta Press Buildings. The units, covering 9,400sq m, would be used for general industry, distribution, storage and offices. Historic printer Headley Brothers previously operated on the site.

🌧️ Flooding across the county last week grounded a number of trains with a landslip in Maidstone bringing the railway line to Ashford to a halt. Commuters took to Twitter to vent their frustration but you get the sense this is the first of many challenges for the train operator this year.

On Our Radar: Maidstone United Find Fortunes On And Off The Pitch

Non-League Maidstone United’s 1-0 victory in the third round of the FA Cup was the big upset from this weekends football. But, the National League South football club’s win over Stevenage won’t just bring glory on the field. The team will net £105,000 in prize money for the win with the potential to generate further revenue from a fourth round tie. The competition rules stipulate that both teams receive an equal 45 per cent share of gate receipts from their tie, regardless of where it is played. Therefore, an away game at the likes of Arsenal or Tottenham could see the team net nearly £1.35 million with additional broadcast revenue likely. However, the team is set to travel to Championship side Ipswich Town in late January who can host nearly thirty thousand spectators in their ground. Match day ticket revenue will likely top over six figures for Maidstone FC from the game but a spot on BBC television would expect to generate the club a further £110,000. Quite the pay day for a club where most of the team are paid only a couple of hundred pounds per week. Enjoy the highlights from the last round here.

Missed last week’s edition? Read it here now…

What does 2024 have in store for Kent Plc

Thanks for reading! We will see you next week.